WHO NEEDS BRANCHES?

Published by Gbaf News

Posted on March 18, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 18, 2014

3 min readLast updated: January 22, 2026

By Thorsten Beck

There is an on-going debate in the UK about competition in the banking system. When it comes to retail banking, this is often mixed with a discussion on the branch networks of UK banks. Recent announcements by high-street banks that they will cut their branch networks are greeted with warnings of loss of competition and lower access to banking services. But is the focus on branch networks really justified when talking about access to banking services and competition? Maybe a look south to the developing world or, more specifically, to East Africa, might be helpful.

Thorsten Beck

In most European countries, more and more banking services are accessed online and not in brick-and-mortar branches. It is more, except for opening (or closing) an account, one barely has to enter a bank branch nowadays to undertake any retail banking business. Obviously, there is a socio-economic dimension to this trend, as it is the younger and more educated that are also more likely to do banking online. In many developing countries, there has been a very different trend. Here it is the lower-income segments that have avoided banking halls, partly put off by high fees and documentation requirements they cannot fulfill, partly by socio-cultural biases (banking is for them, not for us!). And it is here that alternative delivery models have been enormously successful, from using post offices and corner stores to mobile branches (think trucks!) to mobile phone banking. While not the panacea to financial inclusion, it has helped attract a larger share of the population to basic financial services that they need. And in a country like Kenya, where MPesa has attracted a large share of the population to using cell phones for payment services, this has also increased competition in the banking system.

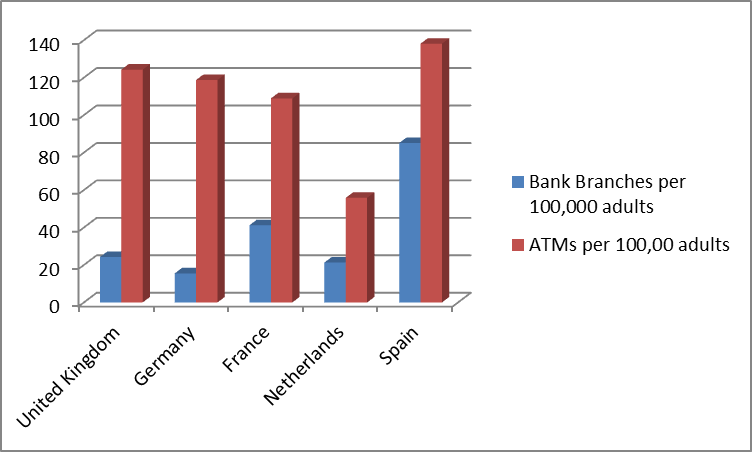

Back to the UK. How does the UK fare in international comparison? Normalizing branches by population, the figure below (based on 2011 data from the IMF’s Financial Access Survey) shows that the UK is not really underbranched. It has more branches per adult than the Netherlands and Germany and fewer than France and significantly fewer than Spain, a country often described as overbanked. Interestingly, when it comes to ATM penetration, UK fares better than three of the comparator countries, with only Spain having more ATMs per capita. Obviously, these are averages numbers and do not tell us about access to branches or ATMs in the northern parts of England or Scotland, but this brings us back to the previous discussion on new delivery channels.

Does cutting branch network signal withdrawal of high street banking and/or lower competition? By itself, certainly not. Other signs are to be considered, including pricing, transparency and customer services. Yours truly, a very recent customer of UK banks, has already benefited from one policy that makes the UK banking system quite competitive at least on the retail side, the account switch service, which significantly reduces the cost of changing banks and puts competitive pressure on retail banks.

Does cutting branch network signal withdrawal of high street banking and/or lower competition? By itself, certainly not. Other signs are to be considered, including pricing, transparency and customer services. Yours truly, a very recent customer of UK banks, has already benefited from one policy that makes the UK banking system quite competitive at least on the retail side, the account switch service, which significantly reduces the cost of changing banks and puts competitive pressure on retail banks.

In summary, the conversation on retail banking and competition should look beyond branches to other delivery channels and other barriers that might prevent individuals from fully benefiting from modern retail banking.

About the Author

Thorsten Beck joined the Faculty of Finance in September 2013 as professor of banking and finance. Since 2008 he has been professor of economics at Tilburg University in the Netherlands and was the founding chair of the European Banking Center from 2008 to 2013. He is also a research fellow of the Centre for Economic Policy Research (CEPR). Full Profile

Explore more articles in the Banking category