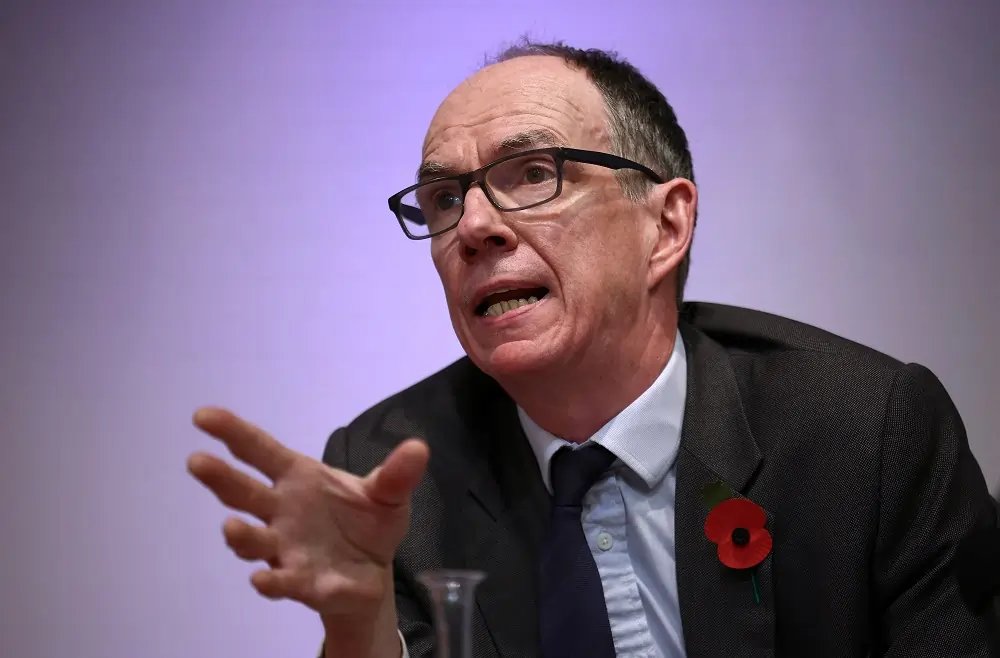

UK inflation could undershoot forecasts, requiring faster rate cuts, BoE’s Ramsden says

Published by Jessica Weisman-Pitts

Posted on November 20, 2024

2 min readLast updated: January 28, 2026

Published by Jessica Weisman-Pitts

Posted on November 20, 2024

2 min readLast updated: January 28, 2026

By David Milliken

LONDON (Reuters) – British inflation is at least as likely to undershoot the Bank of England’s latest forecasts as it is to match them, potentially requiring faster rate cuts, Deputy Governor Dave Ramsden said on Wednesday.

Ramsden voted for the BoE to start cutting rates in May – three months before a majority on the Monetary Policy Committee backed loosening policy – and joined the majority earlier this month who backed a second quarter-point rate cut to 4.75%.

At the time of November’s rate cut, the central bank revised up its inflation forecasts – partly because of stimulus in the new Labour government’s first budget – and forecast inflation would mostly stay above its 2% target until early 2027.

Ramsden said this outturn was “plausible” but that he put at least as high a weight on a scenario under which inflation fell faster “consistent with more symmetry in wages and price setting, with less domestic inflationary pressure.

Employers next year were likely to raise annual pay settlements by an amount in the bottom half of a 2-4% range which they had reported to BoE staff, Ramsden predicted.

“This would imply a scenario in which inflation stays closer to the 2% target throughout the first part of the forecast and falls below 2% more materially later on, lower than in the MPC’s published forecasts,” he said in a speech at the University of Leeds.

Given the uncertain outlook, Ramsden said he would take a “watchful and responsive” approach.

“Were those uncertainties to diminish and the evidence to point more clearly to further disinflationary pressures … then I would consider a less gradual approach to reducing Bank Rate to be warranted,” he added.

The BoE’s central forecasts this month were based on market expectations of interest rates falling to 3.75% by late 2025. Markets now only see two or three BoE rate cuts next year.

(Additional reporting by Sachin Ravikumar)

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. Central banks attempt to limit inflation to stabilize the economy.

The Bank of England is the central bank of the United Kingdom, responsible for issuing currency, maintaining monetary stability, and overseeing the financial system.

Interest rates are the cost of borrowing money or the return on savings, typically expressed as a percentage. They are influenced by central bank policies and economic conditions.

Monetary policy refers to the actions taken by a central bank to manage the money supply and interest rates to achieve macroeconomic objectives like controlling inflation and stabilizing currency.

The Monetary Policy Committee (MPC) is a group within the Bank of England responsible for setting interest rates and making decisions regarding monetary policy to achieve inflation targets.

Explore more articles in the Finance category