Navigating the wall of worry with small caps

Published by Gbaf News

Posted on October 24, 2018

5 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on October 24, 2018

5 min readLast updated: January 21, 2026

By Eric McLaughlin

US small-cap stocks lost their lead over blue chips in early October’s sell-off, which was likely prompted by fears of higher interest rates.

We believe such fears were unjustified and that the sell-off was a correction in a bull market.

The environment for investors in US equity continues to be skewed towards the positive. Recent US economic reports have been encouraging: real gross domestic product (GDP) increased by 4.2% in the second quarter of 2018, according to the second estimate by the Bureau of Economic Analysis. In addition, the ISM Manufacturing Survey is reporting a reading showing robust expansion and the latest jobs report was strong, with the unemployment rate at the lowest level since 1969.

Meanwhile, the third quarter earnings season has begun well extending the run of strong realised earnings growth seen so far this year along with healthy expectations for future growth.

The continued strength of the US economy, partially driven by tax cuts and fiscal spending, meant that investor and business confidence has remained robust.

Shifting expectations for monetary policy made themselves felt

At a press briefing in mid-September Chairman Powell was extraordinarily positive on the economic outlook. In addition he recently commented that the stance of monetary policy remains “a long way from neutral” and may ultimately need to move into restrictive territory.

While these comments should not have been a surprise to investors (they are aligned with the FOMC’s economic and interest rate projections), they do represent a change in thrust from Chairman Powell who had previously focused only on the need to normalize policy gradually over time, staying away from sharing his own view on whether policy would eventually turn restrictive.

These comments from Chairman Powell likely contributed to higher anticipated policy rates and the rise in Treasury yields.

Small caps have had a strong run…

During the six months through August 2018 small caps outperformed large caps for five of the months. This corresponds to the period from March when the possibility of a trade war began to gain attention. Small caps’ outperformance over large caps since February is the strongest since the global financial crisis (+15.6% vs + 7.6%). In our view the idea that small-cap stocks represented a relatively safe bet under this scenario was justified. The level of outperformance left small caps due a correction versus large caps (see Exhibit 1 below).

Exhibit 1: Having outperformed in 2018 year-to-date through August small caps underperformed large caps in the recent correction

Source: Datastream, BNPP AM au 17/10/2018

Early October was a correction, not the start of a bear market

We do not view the early October market correction as the beginning of a bear market for small cap stocks. As we’ve noted, the market sell-off was primarily triggered by fears of rising rates. In this context, leverage mattered during the sell-off, when the most levered stocks underperformed their clean balance sheet peers. The current buoyant US economic backdrop should continue to support US earnings and will, in our view, more than compensate for the rise in bond yields, certainly in the short term.

Nor do we anticipate that the transition by the FOMC to a more neutral stance will be sufficient abrupt to bring the current expansion to a halt. Gradual normalisation remains a (realisable) objective given the absence of inflationary pressures. And at the same time fiscal stimulus will also continue to make itself felt.

Given the extent of the recent correction in small caps we view it as a buying opportunity.

Reaffirming the case for small caps

In our view the rationale that has led investors to seek out smaller companies remains intact:

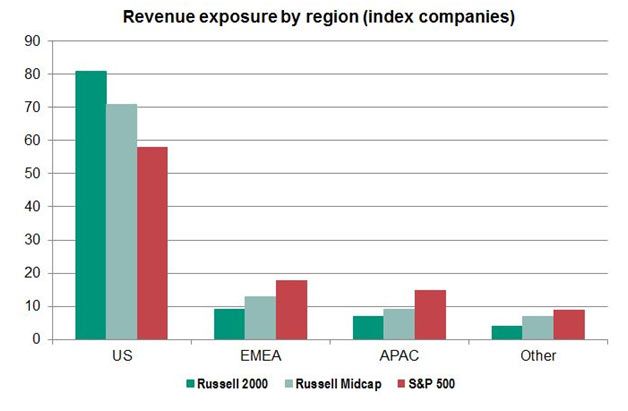

Exhibit 2: Domestic nature of US small caps

Source: FactSet, as at 31/08/2018

Let us state clearly that in our assessment, an all-out trade war will be avoided and an agreement will be reached to avoid major damage to the global economy. Given the risks, however, we think that US companies with higher levels of exposure to domestic rather than international sources of revenues look more attractive and are better insulated from trade issues. This means small-cap stocks.

Scope for continued optimism

We remain upbeat on small caps following the broad-based strength in earnings reports and continued expectations for earnings growth acceleration into the final quarter. We also view valuations as attractive following the recent correction. Valuations are below their long-term averages. Russell 2000 PE is back to levels prior to the 2016 elections. Yet, the index has gained over 40% during that time frame. Thus, earnings have been the driver. Assuming the geopolitical backdrop does not worsen and derail economic expansion, we expect the US Federal Reserve to continue to raise policy rates slowly, bond yields to climb and the US dollar to firm modestly over the coming months.

To emphasise the point, underlying macroeconomic conditions are sufficiently robust in our view so as to justify a small-cap tailwind. As consumers and companies continue to feel the positive effects of economic expansion, the fundamentals are likely to keep improving as well, which should also buoy small-cap stocks.

In our judgement, the fundamentals suggest this equity bull market will continue. While a recession would likely end the bull run, we see little evidence of a deteriorating environment. To the contrary, economic growth is accelerating. Meanwhile, in the wake of the recent correction small caps are trading at a discount to their long-term relationship with large caps.

Explore more articles in the Investing category