Navigating Market Volatility with a Dynamic Portfolio Strategy

By Surajit Saha

Investors and asset managers seek strategies that balance risk and growth during market volatility. Traditional portfolio models, like the 60/40 equity bond asset allocation, have been decades-long staples but are increasingly challenged by prolonged low interest rates, inflation, and unpredictable market shifts.

Innovative portfolio strategies, such as those incorporating the Dragon Portfolio, integrate diverse asset classes like equities, fixed income, commodities, gold, and long-volatility assets using respective exchange-traded funds (ETF). Using the concept of Dragon Portfolio and dynamically adjusting allocations tactically with advanced tools like technical analysis and leveraged ETFs, a new alternative investment strategy provides a robust framework for navigating downturns, capturing recoveries, and building long-term resilience.

Evolution of investment and portfolio strategies

The 60/40 portfolio model—60 percent equities and 40 percent bonds—offers a balance of growth and stability. Sudden market downturns and unexpected inflation have diminished its effectiveness, highlighting the need for alternatives that include broader asset diversification. The year 2022 saw equities and long-term bonds decline in price by 20 to 30 percent, demonstrating the vulnerability of even one of the most widely used balanced asset allocation strategies.

ETFs have emerged as a solution, offering cost-effective, diversified market access. Investors now use thematic and sector-based ETFs to align portfolios with specific goals. While ETFs simplify portfolio management, static buy-and-hold strategies can still struggle during periods of extreme volatility.

Expanding on the Dragon Portfolio framework, a new innovative proprietary strategy, the Stability Powered Expansion Strategy (SPE Strategy), diversifies across equities, fixed income, commodities, gold, and long-volatility ETFs, incorporating dynamic adjustments through leveraged and inverse ETFs to respond to market shifts. The switching between normal to leveraged or inverse ETFs for the equity part is determined by technical analysis.

Commodities offer a hedge against inflation, as their prices often rise during economic uncertainty due to inflation. Gold, a traditional haven, provides additional stability and historically appreciates during low-interest regimes. Long-volatility ETFs, which gain value when market fear spikes, act as a counterbalance to equity losses during downturns. These elements and equity and bonds collectively enhance the portfolio’s ability to perform across various economic conditions. During any phase of the economy, two to three of the five asset classes are expected to counterbalance the price correction of others, providing overall stability to the portfolio.

Leveraged ETFs and adaptive allocation

Leveraged ETFs amplify daily market movements, offering two to three times the performance of their underlying indices. While these instruments are not suited to passive buy-and-hold approaches, they are highly effective in adaptive strategies that actively manage risk and opportunity.

While having the five asset classes helps provide stability, using leveraged ETFs during an equity market upmove will help boost the portfolio’s return. This portfolio strategy divides investments into two components:

Daily rebalancing, enabled by the T+1 settlement system, ensures precise responses to short-term market trends. This strategy combines the benefits of passive instruments with the agility of active management, capturing returns while limiting risks.

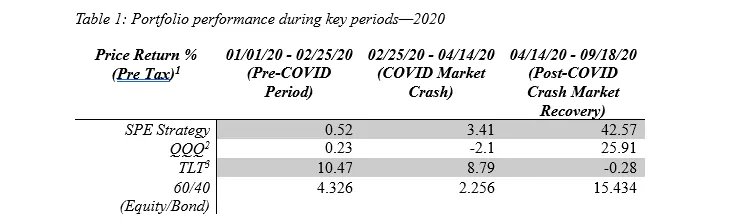

Real-world performance Back-tested data by the author illustrates the effectiveness of this approach during volatile and recovery periods. For instance, during the COVID-19 market crash (February 25 to April 14, 2020), the Stability Powered Expansion Portfolio strategy achieved a return of 3.41 percent (Table 1).

Significantly, during the recovery phase (April 14 to September 18, 2020), the portfolio returned 42.57 percent, driven by increased exposure to leveraged ETFs such as TQQQ. These results underscore the strategy’s ability to adapt to changing market conditions and capitalize on opportunities with dynamic risk exposure as per market sentiment. In both scenarios, the portfolio outperformed equity-only and 60/40 equity bond portfolios.

The adaptive allocation process mitigates drawdowns and ensures the portfolio remains positioned for recovery. This is a key departure from the static nature of traditional models, which often lag dynamic market shifts.

Compliance and regulatory considerations

While leveraged ETFs offer compelling opportunities for portfolio enhancement, their complexity and risks make regulatory compliance a critical aspect of their use. It is imperative for financial advisors and fund managers to adhere to stringent guidelines, which mandate clear disclosures about the risks associated with these instruments. It is also critical for advisors to demonstrate a reasonable basis for including leveraged ETFs in client portfolios and ensure these choices align with their clients’ investment objectives.

Investor awareness and risk disclosure

A significant challenge in utilizing leveraged ETFs is ensuring investors understand these products’ amplified risks. Leveraged ETFs are inherently short-term tools designed to maximize gains over daily market movements rather than long-term trends. As a result, they are more suitable for experienced investors or those with a clear understanding of their potential for rapid value fluctuations.

The strategy incorporates education and transparency to address these challenges, requiring investors to acknowledge the short-term nature of leveraged ETFs and the possibility of amplified losses during downturns. The strategy ensures compliance by embedding these considerations into the portfolio design and communication and serves as a foundation for informed decision-making in the best interest of the client.

Simplifying compliance through ETF packaging

Investors can envision the SPE Portfolio strategy as a bundled future ETF product to streamline compliance further, an approach that consolidates the diverse components into a single, manageable entity. This process allows advisors to recommend the strategy without navigating the complexities of multiple individual ETFs. By incorporating regulatory guidelines into the product design, the packaged ETF would simplify adherence to all compliance and regulations, making it more accessible for advisors and their clients.

Addressing industry trends and innovations in wealth management

The growing popularity of alternative investments aligns with broader wealth management trends. Analysts project that alternative assets will increase from 12 percent to 15 percent of total assets under management (AUM), while active management is expected to account for 60 percent of global AUM. These shifts reflect the demand for flexible and adaptive strategies to address evolving investor needs.

Technological advancements such as artificial intelligence (AI), robotics, big data, and blockchain are reshaping wealth management by enabling faster decision-making, enhancing transparency, and improving trade execution efficiency. Technical analysis, powered by advanced charting tools, leverages these innovations to identify market trends and inform real-time portfolio adjustments. This aligns with the findings of the EY Global Wealth Management Industry Report, which highlights how greater diversification may give clients exposure to more varied returns for their investment portfolio attributed to the short-term performance of alternative assets.

The new portfolio strategy exemplifies the industry’s embrace of innovation by integrating the benefits of passive instruments like ETFs with the agility of active management. By using technical analysis and alternative assets, the approach aligns with insights from the McKinsey 2024 Investment Management Outlook, which highlights the increasing demand for a broader range of investment solutions for asset managers.

Winning asset management formula

The challenges of modern markets demand resilient, adaptable, and innovative strategies. By integrating diverse asset classes, leveraging advanced tools like technical analysis, and aligning with industry trends, the SPE Strategy sets a benchmark for future wealth and asset management practices. Such approaches enable investors to navigate complexity, achieve growth, and manage risk, providing a clear blueprint for success in an ever-changing financial landscape.

About the Author:

Surajit Saha works as a product owner with over 15 years of experience in product management and business and systems analysis. He is passionate about financial investment and portfolio management. He holds a bachelor of engineering degree in information technology and a certificate in management and has passed CFA Level 1. Connect with Surajit on LinkedIn.

The information provided in this article is intended for informational and educational purposes only. No investment decisions should be made without the advice of a financial advisor. The article is not an investment recommendation and past performance is not a guarantee of future returns.

Footnotes:

Surajit Saha

The Dragon Portfolio is an investment strategy that diversifies across various asset classes, including equities, fixed income, commodities, gold, and long-volatility assets, to manage risk and enhance returns.

Leveraged ETFs are exchange-traded funds that use financial derivatives and debt to amplify the returns of an underlying index, typically providing two to three times the performance.

The SPE Strategy is a dynamic investment approach that adjusts asset allocations based on market conditions, utilizing traditional, leveraged, and inverse ETFs to optimize performance.

Portfolio diversification is an investment strategy that involves spreading investments across various asset classes to reduce risk and improve returns.

ETFs are investment funds that are traded on stock exchanges, similar to stocks, and typically hold a diversified portfolio of assets, allowing investors to gain exposure to various markets.

Explore more articles in the Business category