INTELLINX RELEASES ENTERPRISE ALERT AND CASE MANAGER 5.1 PROVIDING ACKNOWLEDGMENT MANAGEMENT WITH FINCEN SAR E-FILING

Published by Gbaf News

Posted on May 22, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 22, 2014

2 min readLast updated: January 22, 2026

New version increases efficiency and improves compliance

Intellinx Ltd., the innovative leader in enterprise fraud management announced the release of the Intellinx Enterprise Alert and Case Manager (ECM) version 5.1. This latest version includes management of Suspicious Activity Reports (SAR), e-Filing acknowledgments from the Financial Crimes Enforcement Network (FinCEN). This new capability enables compliance officers and fraud investigators to manage FinCEN acknowledgements as part of the SAR workflow within ECM thereby reducing companies’ liability and avoiding fines related to incomplete or untimely filing of SARs. Implemented at dozens of financial institutions including two of the largest US banks, Intellinx ECM currently manages thousands of SAR’s per month.

In addition to automatic acknowledgment from FinCEN, Intellinx ECM automates the full SAR filing process including identifying the need to file a SAR, pre-populating SARs from different data sources, e-filing, notifying case managers and investigators of the SAR status and next steps. ECM also includes full reporting on SAR processing to increase overall efficiency and productivity of everyone involved with managing SAR’s.

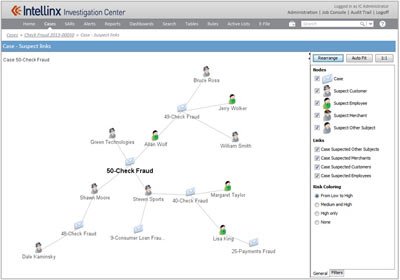

ECM Screenshot

SAR filing regulations is demanding more resources from financial institutions each year, and incomplete or untimely filing is exposing them to increased risk. According to the latest SAR Activity Report, over 1.5 million reports were filed during the calendar year 2012 where filings for depository institutions increased 8% compared to the previous year. Most medium sized banks file between 50 – 100 reports per month, with larger banks filing may exceed 1,000 reports per month.

Intellinx ECM comes pre-configured to comply with FinCEN regulations, and also has the flexibility to be adapted to any other national financial regulatory authority and each organization’s workflows. The dynamic link analysis feature creates relationships between events and people to identify trends and potential collaboration. ECM is fully integrated into Intellinx’s anti-fraud suite offering unique patented user behavior profiling highly effective for detecting and preventing both internal and external fraud and data theft.

“Our e-filing management system which now also includes automatic acknowledgment, enables enterprises to respond quickly and effectively to fraud attempts”, said Boaz Krelbaum, Intellinx Co-founder, CTO and US General Manager. “Intellinx provides various anti-fraud and compliance solutions on one unified platform to keep our customers total cost of ownership exceptionally low, while enabling them to keep their productivity and level of compliance high.”

Explore more articles in the Top Stories category