Hermes: Eurozone ‘Misery Indices’ – converging on the strongest once again

Published by Gbaf News

Posted on July 26, 2018

8 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on July 26, 2018

8 min readLast updated: January 21, 2026

To test whether the macro strains in the eurozone periphery are still holding back the core members, Neil Williams, Senior Economic Adviser to Hermes Investment Management, updates his ‘Misery Indices’ (MIs) out to 2019. He finds that, with macro-economic convergence between euro members next year set to be the strongest since 2007, they should be on a better footing to weather their next challenge – linked perhaps to Italy’s political risk.

Off-the-wall methods for proxying economic hardship include an index adding together a country’s unemployment and inflation rates.

Though hardly scientific, they become especially flawed in a low inflation or deflationary world when the components may move in opposite directions. We offer a more logical alternative to this, and to GDP estimates, which are produced with more of a time lag and frequently revised.

Our MIs are the sum of two parts:

We use Eurostat data and OECD/our CPI and unemployment projections to the end of 2019 to: (i) highlight the disparities still; (ii) quantify the degree/direction of convergence; and (iii) test whether the debtor countries are still an increasing drag on the core.

Converging on the strongest once again

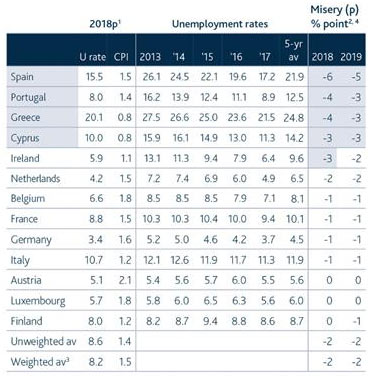

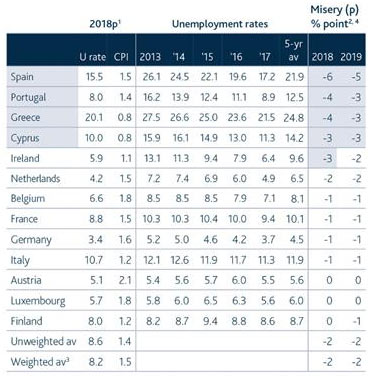

Chart 1 summarises our predictions to 2019. Rising MIs predict greater economic hardship, relative to that country’s past. On this basis, it offers the following observations.

Chart.1 The method & sample data behind our Misery Indices (MIs)

The lower the ‘Misery Index’, the greater the expected economic improvement

1 Standardised unemployment (%), & HICPs (%yoy).

2 Absolute CPI deviation from 1.9% (+) added to u rate deviation from 5-yr av (+/-).

3 Using adjusted GDP weights.

4 Blue shaded areas suggest ‘faster than average misery reduction’.

Source: Hermes’ MIs, based on Eurostat data, & Hermes, & OECD projections (p).

First, after a marked deterioration in eurozone members’ MIs during the global crisis, improvement since 2014 looks to be sustained through to 2019. As a bloc, the eurozone’s (weighted) MI should, at -2, be its lowest since 2001.

Second, with growth now resuming, it’s not surprising to see the sharpest improvement in most of those members that from 2010 ran austerity to cut deficits and debt. Spain, Portugal, Greece, and Cyprus’ MIs are now lower, albeit from a previously high base. For some others, though, unemployment and deflationary pressures from the fiscal squeeze are still dampening improvement in their relative positions. In 2018, Italy will for the ninth year running lie in the above-average-misery zone in Chart 1. But, even this is much improved on 2010-14, and further gains look likely across the periphery.

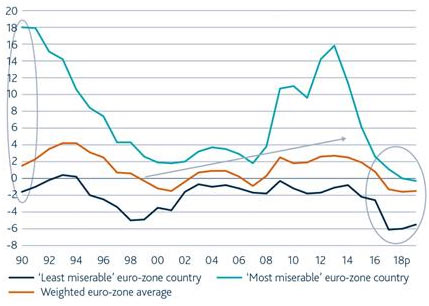

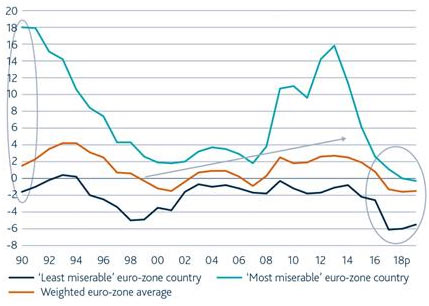

Still, most revealing is what our MIs say about convergence (Chart 2). Looking back, the dip in the eurozone’s weighted average MI from the mid 1990s reflects Germany’s recovery after its 1992-93 unification-led recession, and the benefits as the converging countries tried to reduce inflation, bond yields, debt and deficits. Our MIs reveal the two stages: from Maastricht in 1992 to the euro’s birth; and thereafter, with the euro, a steady re-widening as policy discipline waned.

Chart 2. Divergence between the periphery & core continues to correct

The lower the ‘Misery Index’, the greater the relative economic improvement

Source: Hermes’ MIs, based on Eurostat data, & Hermes & OECD projections (p)

Convergence after Maastricht was solid. We proxy it by tracking the highest and lowest MIs each year. In 2018, Spain looks the ‘happiest’ relative to its recent past (GDP averaging +3.3%yoy since 2015), with Finland relatively the ‘least happy’ (+1.5%yoy). Greater convergence is shown by the narrowing gap between the two extremes. Looking forward, it suggests 2019 should see the joint largest degree of convergence since 2007, with the periphery leading the charge.

This combination of reducing strains in the periphery with slower relative improvement in the core means divergence since the crisis is correcting. This is encouraging, though not sufficient for sustaining economic health. This still rests on the core, which account for 80% of eurozone GDP: but, their MIs are also better.

So, while tackling the eurozone crisis needed more than just low rates and QE, without them, Spain, Italy and others’ competitiveness gains may have been offset by a stronger euro. However, while not fixed, euro members should be on a better footing to weather their next market challenge – linked perhaps to Italy’s political risk.

To test whether the macro strains in the eurozone periphery are still holding back the core members, Neil Williams, Senior Economic Adviser to Hermes Investment Management, updates his ‘Misery Indices’ (MIs) out to 2019. He finds that, with macro-economic convergence between euro members next year set to be the strongest since 2007, they should be on a better footing to weather their next challenge – linked perhaps to Italy’s political risk.

Off-the-wall methods for proxying economic hardship include an index adding together a country’s unemployment and inflation rates.

Though hardly scientific, they become especially flawed in a low inflation or deflationary world when the components may move in opposite directions. We offer a more logical alternative to this, and to GDP estimates, which are produced with more of a time lag and frequently revised.

Our MIs are the sum of two parts:

We use Eurostat data and OECD/our CPI and unemployment projections to the end of 2019 to: (i) highlight the disparities still; (ii) quantify the degree/direction of convergence; and (iii) test whether the debtor countries are still an increasing drag on the core.

Converging on the strongest once again

Chart 1 summarises our predictions to 2019. Rising MIs predict greater economic hardship, relative to that country’s past. On this basis, it offers the following observations.

Chart.1 The method & sample data behind our Misery Indices (MIs)

The lower the ‘Misery Index’, the greater the expected economic improvement

1 Standardised unemployment (%), & HICPs (%yoy).

2 Absolute CPI deviation from 1.9% (+) added to u rate deviation from 5-yr av (+/-).

3 Using adjusted GDP weights.

4 Blue shaded areas suggest ‘faster than average misery reduction’.

Source: Hermes’ MIs, based on Eurostat data, & Hermes, & OECD projections (p).

First, after a marked deterioration in eurozone members’ MIs during the global crisis, improvement since 2014 looks to be sustained through to 2019. As a bloc, the eurozone’s (weighted) MI should, at -2, be its lowest since 2001.

Second, with growth now resuming, it’s not surprising to see the sharpest improvement in most of those members that from 2010 ran austerity to cut deficits and debt. Spain, Portugal, Greece, and Cyprus’ MIs are now lower, albeit from a previously high base. For some others, though, unemployment and deflationary pressures from the fiscal squeeze are still dampening improvement in their relative positions. In 2018, Italy will for the ninth year running lie in the above-average-misery zone in Chart 1. But, even this is much improved on 2010-14, and further gains look likely across the periphery.

Still, most revealing is what our MIs say about convergence (Chart 2). Looking back, the dip in the eurozone’s weighted average MI from the mid 1990s reflects Germany’s recovery after its 1992-93 unification-led recession, and the benefits as the converging countries tried to reduce inflation, bond yields, debt and deficits. Our MIs reveal the two stages: from Maastricht in 1992 to the euro’s birth; and thereafter, with the euro, a steady re-widening as policy discipline waned.

Chart 2. Divergence between the periphery & core continues to correct

The lower the ‘Misery Index’, the greater the relative economic improvement

Source: Hermes’ MIs, based on Eurostat data, & Hermes & OECD projections (p)

Convergence after Maastricht was solid. We proxy it by tracking the highest and lowest MIs each year. In 2018, Spain looks the ‘happiest’ relative to its recent past (GDP averaging +3.3%yoy since 2015), with Finland relatively the ‘least happy’ (+1.5%yoy). Greater convergence is shown by the narrowing gap between the two extremes. Looking forward, it suggests 2019 should see the joint largest degree of convergence since 2007, with the periphery leading the charge.

This combination of reducing strains in the periphery with slower relative improvement in the core means divergence since the crisis is correcting. This is encouraging, though not sufficient for sustaining economic health. This still rests on the core, which account for 80% of eurozone GDP: but, their MIs are also better.

So, while tackling the eurozone crisis needed more than just low rates and QE, without them, Spain, Italy and others’ competitiveness gains may have been offset by a stronger euro. However, while not fixed, euro members should be on a better footing to weather their next market challenge – linked perhaps to Italy’s political risk.

Explore more articles in the Investing category