The ability to draw deep customer insights from Big Data and bring those insights into marketing decisions is transforming the marketing function at banks around the world. Leveraging new technologies, bank marketers can now make targeted, personalized offers to individual customers at the precise moment when the customer is most likely to respond. And, marketers can use the communications channel that will be most effective for a given customer, including email, text and social networks.

These personalized offers take into consideration the customer’s propensities, current banking relationship and historical behavior, as well as the bank’s business objectives – e.g., promoting a new lending product, or driving greater credit utilization to increase return on capital. By looking at all of these factors together, each offer represents the best marketing decision at a given point in time.

The need for Big Marketing now

Marketers need this new source of propulsion. While many banks have long used data and technology for risk management and fraud prevention, most banks are not performing data-driven, individualized marketing on a massive scale. Marketing is still largely operations-centric, with customers receiving offers based on regularly scheduled promotions.

That’s a problem for marketers who are trying to break through the wall of noise created by the 16,000+ marketing messages that the average consumer experiences each day.

In retail banking, where financial institutions struggle to retain valuable customers, Big Marketing holds the key to increased profitability through cross-selling and up-selling current customers as well as attracting new customers.

There are five essentials for turning Big Data into optimal bank marketing decisions.

- Establish processes to understand each customer

Retail banks have much to gain from understanding patterns of behavior across products. For customers with debit and credit cards, for example, what types of purchases are being made on each card? When there are shifts in an established pattern, what do they reveal about the customer’s circumstances or preferences? If a customer is shifting more grocery purchases from debit to credit, is that indicative of an effective rewards-based credit card promotion, a sign of growing risk or, given everything known about the customer, is it an opportunity to offer overdraft protection?

To pull useful insights from all of the data available about each customer, banks are turning to increasingly sophisticated data management, modeling and processing technologies, including new software that can help analyze traditional types of data as well as unstructured data, like browsing activity, Facebook pages, tweets and online reviews.

Recent advances make it possible to do this through cloud-based software as a service (SaaS) solutions, which knock down entry barriers and accelerate startup times for Big Marketing projects. The SaaS approach also enables banks to take advantage of the latest technologies while avoiding the time and cost of deploying and integrating complex systems into an IT infrastructure. - Find the real predictors of customer behavior

What motivates customers to take action is often the result of a complex, subtle interplay of factors. As banks shift from traditional methods of sending out offers to generating individualized offers, it’s important to avoid using overly simplistic behavioral triggers based solely on isolated bits of information. Rather, banks must look at the interplay between all the bits of data about a given consumer to understand the best offer to make.

Is it effective, for instance, for a bank to create a business rule that says “whenever a customer with an acceptable risk score spends more than $400 at a tire store, send them an offer for an auto loan?” Probably not. Methods like predictive models allow marketers to leverage insight from more intricate behavior, including combinations of past transactions rather than a single trigger transaction.

The expanding Big Data universe makes it possible to discover ever-more complex and subtle behavioral patterns that aren’t evident in smaller, more homogeneous data sets. Advanced data mining techniques like genetic algorithms find formerly unrecognized customer attributes and reveal more relationships between these attributes. Model builders have the opportunity to pinpoint attributes that are highly predictive of certain behaviors, as well as to combine them in innovative ways into new attribute summaries – i.e., unique behavioral predictors for a particular bank and potentially a source of competitive advantage. - Scientifically balance all factors in complex marketing decisions

As banks take more analytic predictions into consideration when making marketing decisions, the process grows more complex. Banks that rely on simple business rules alone (“If the customer does Y, then the bank should do Z”) soon find it difficult to manage or even fully comprehend how they are making decisions.

Action-effect models are a key technique for overcoming this challenge. These models use the outputs of multiple predictive models (e.g., a propensity model for determining the likelihood a customer will apply for a HELOC, and a time-to-event model that says it’s probably going to happen in the next 30 days). Action-effect models combine these outputs with other data to predict how the customer is likely to react to a particular action by the bank(e.g., offer a special introductory rate) and what effect the offer would have on the bank’s KPIs (e.g., portfolio risk profile, revenue, share of wallet).

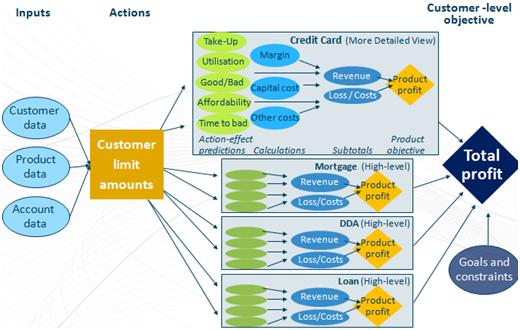

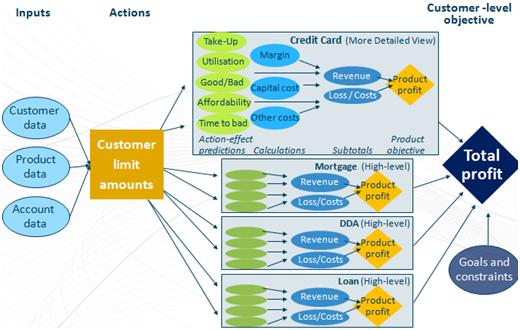

FICO recently used this approach in a project for a large European bank. The objective was to improve credit-limit decisions by finding the best allocation of preferred limits for each customer across four retail lending products: credit cards, unsecured loans, mortgages and overdraft services. To achieve this objective, we built action-effect models for each product, assessing the impact of different limits on a wide range of profit drivers (e.g., utilization, delinquency rates) enabling the bank to understand the balance between revenue, credit risk, capital utilization, etc.

Figure 1: Sample representation of a decision model for a retail banking credit line decision

Decision models like these simplify Big Marketing decision processes. They encompass all the complexity and distill it down to an actionable result, such as a recommended offer. - Answer “million dollar” marketing questions

Decision modeling, optimization and simulation can also be used to answer difficult questions, such as “If we offer 10,000 customers a credit card with a below-market introductory interest rate, what percentage of those 10,000 customers do we want to accept the offer?” The answer can help the bank maximize new revenue without taking on too much risk or reducing its bottom-line profitability.

FICO worked with an Asian lender to increase usage of an installment loan product attached to a credit card by figuring out “Which customers are likely to increase their loan utilization if offered a 30% reduction on the interest rate, and which customers would be sufficiently incentivized with only a 10% reduction?” The technique is helping the lender better understand the subtle relationships between interest rates, utilization and delinquency in a market where consumers have traditionally been reluctant to take on debt. - Learn from what is happening in the market now

Because Big Marketing decisioning is based not only on historical data, but also on data being collected frequently— often in real time —from many sources, it’s very responsive to change.

Banks can use analytic learning loops to rapidly measure how customers are responding and adjust decision strategies where necessary while campaigns are still underway. This systematic method for rapid testing and learning can show, for example, where propensity score cutoff points need to be for a more cost-effective campaign.

Marketers don’t have to wait for all of the data to come in to determine which strategies are working and which aren’t. By comparing early actual results on KPI metrics against simulated results, analysts can extrapolate longer-term outcomes. In this way, marketers can take quicker action, accelerating test-and-learn cycles and implementing changes in minutes.

Conclusion

In the Big Data era, it is time for banks to put customers at the center of every marketing decision. While marketers have been working toward this for years, today’s Big Marketing techniques will help them rise above the obstacles and finally realize that goal.

There are significant challenges ahead, but the opportunities are considerable. The path from the potential of Big Data to the payoff of Big Marketing Will be different for every bank. The analytic insights that prove most valuable in enabling one bank to serve its customers in a way that creates competitive advantage will likely be different from what proves most valuable to another bank. But one thing is certain, Big Marketing can deliver unmatched competitive advantages today, and it will be table stakes very soon. Banks must embrace Big Marketing or face the prospect of falling behind their more progressive and visionary competitors.

Sally Taylor-Shoff is vice president of product marketing in FICO’s Banking Practice. She has more than 20 years of experience in financial services. She blogs at http://FICOlabsBlog.fico.com/.