FEBRUARY 2014 FIGURES FOR THE HIGH STREET BANKS

Published by Gbaf News

Posted on March 27, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 27, 2014

2 min readLast updated: January 22, 2026

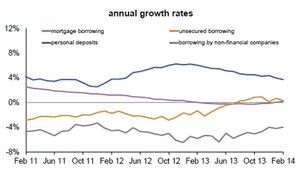

New mortgage lending and approvals for buying new homes are around 50% higher than a year ago. Borrowing demand from businesses is improving, with manufacturers, wholesale & retail sectors having expanded their borrowing from a year ago.

BBA Chief Economist Richard Woolhouse said:

“These encouraging figures show that the demand for finance is broadening out across both the consumer and commercial markets, with mortgage approvals and lending to many types of business on the up.

“Mortgage lending has leapt 50 per cent since this time last year, whilst we are now beginning to see growth in net lending to manufacturers and retailers.

“This shows that the banks are helping businesses who are looking to invest as well as ordinary homebuyers as part of their sustained support for recovery across the economy.”

John Allan, National Chairman, Federation of Small Businesses commented, “While it is good to see that demand for finance from businesses is improving and lending is on the rise, the launch of the first ever banking survey – Business Banking Insights (BBI) will give us unique access of finance evidence cut by each bank. The BBI will allow small businesses to rate banking services and will be launched in May. This will deliver brand new information as to how micro, small and medium size businesses feel about dealing with their banks.

John Allan, National Chairman, Federation of Small Businesses commented, “While it is good to see that demand for finance from businesses is improving and lending is on the rise, the launch of the first ever banking survey – Business Banking Insights (BBI) will give us unique access of finance evidence cut by each bank. The BBI will allow small businesses to rate banking services and will be launched in May. This will deliver brand new information as to how micro, small and medium size businesses feel about dealing with their banks.

The BBA statistics shows a number of sectors, including manufacturing and retail, have expanded their borrowing from a year ago; however, it is disappointing that the numbers for January and February 2014 combined are still lower than the 6-month average of business lending. Clearly, there are still improvements to be made, especially for small businesses, who struggle the most to secure lending throughout the economic downturn.

“We eagerly await the results of the BBI, which is supported by the Federation of Small Businesses (FSB) and the British Chambers of Commerce (BCC), as this will help to drive a new era of transparency and understanding in UK business banking.”

Explore more articles in the Top Stories category