China bans export of key minerals to U.S. as trade frictions escalate

Published by Jessica Weisman-Pitts

Posted on December 3, 2024

3 min readLast updated: January 28, 2026

Published by Jessica Weisman-Pitts

Posted on December 3, 2024

3 min readLast updated: January 28, 2026

By Amy Lv and Tony Munroe

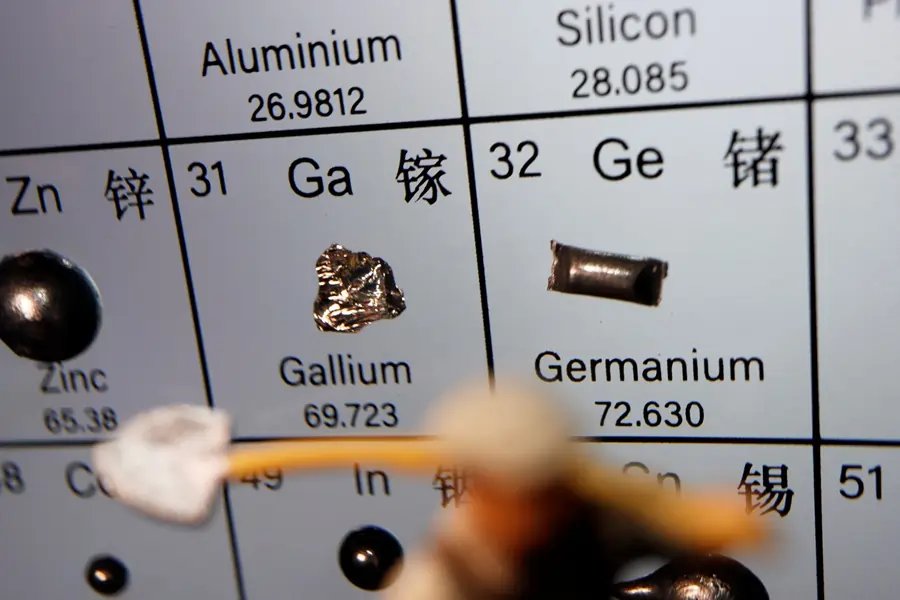

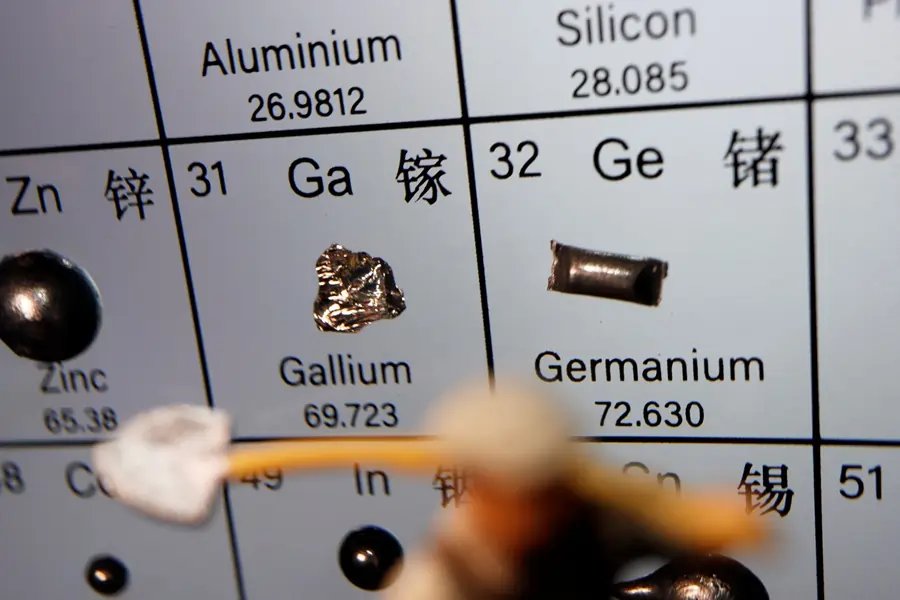

(Reuters) -China has banned exports to the United States of items related to the minerals gallium, germanium and antimony that have potential military applications, it said on Tuesday, a day after Washington’s latest crackdown on China’s chip sector.

A commerce ministry directive on dual-use items with both military and civilian applications cited national security concerns. The order, which takes immediate effect, also requires stricter review of end-usage for graphite items shipped to the U.S..

“In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted,” the commerce ministry said.

The curbs strengthen enforcement of existing limits on exports of the critical minerals that Beijing began rolling out last year, but apply only to the U.S. market, in the latest escalation of trade tensions between the world’s two largest economies ahead of President-elect Donald Trump taking office.

Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the U.S. this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier.

Gallium and germanium are used in semiconductors, while germanium is also used in infrared technology, fibre optic cables and solar cells.

Similarly, China’s overall October shipments of antimony products plunged by 97% from September after Beijing’s move to limit its exports took effect.

China accounted last year for 48% of globally mined antimony, which is used in ammunition, infrared missiles, nuclear weapons and night-vision goggles, as well as in batteries and photovoltaic equipment.

This year, China has accounted for 59.2% of refined germanium output and 98.8% of refined gallium production, according to consultancy Project Blue.

“The move is a considerable escalation of tensions in supply chains where access to raw material units is already tight in the West,” said Project Blue co-founder Jack Bedder.

Prices of antimony trioxide in Rotterdam had soared by 228% since the beginning of the year to $39,000 a metric ton on Nov. 28, data from information provider Argus showed.

“Everyone will dig in their backyard to find antimony. Many countries will try to find antimony deposits,” said a minor metals trader in Europe, declining to be named.

China’s announcement comes after Washington launched its third crackdown in three years on China’s semiconductor industry on Monday, curbing exports to 140 companies, including chip equipment maker Naura Technology Group.

Trump, whose first White House term was marked by a bitter trade war with China, has said he will implement 10% tariffs on Chinese goods and threatened 60% tariffs on Chinese imports during his presidential campaign.

“It comes as no surprise that China has responded to the increasing restrictions by American authorities, current and imminent, with its own restrictions on the supply of these strategic minerals,” said Peter Arkell, chairman of the Global Mining Association of China.

“It’s a trade war that has no winners,” he said.

Separately, several Chinese industry groups called on Tuesday for their members to buy domestically made semiconductors, with one saying U.S. chips were no longer safe and reliable.

(Reporting by Amy Lv, Ella Cao and Ryan Woo in Beijing, Tony Munroe in Singapore, and Ashitha Shivaprasad in Bengaluru; Editing by Jacqueline Wong, Neil Fullick, Raju Gopalakrishnan, Jan Harvey and Catherine Evans)

Gallium is a chemical element used in electronics, particularly in semiconductors and LEDs. It has applications in high-temperature thermometers and is crucial for modern technology.

Germanium is a metalloid used in semiconductors and fiber optics. It plays a vital role in electronic devices and is essential for infrared optics.

Antimony is a chemical element used in flame retardants, batteries, and ammunition. It has applications in various industries, including electronics and metallurgy.

Dual-use items are products that can be used for both civilian and military applications. Their export is often regulated to prevent misuse.

A trade war occurs when countries impose tariffs or other trade barriers on each other to protect their domestic industries, leading to escalating tensions and economic impacts.

Explore more articles in the Top Stories category