BREMER BANK COUNTS ON TALARI’S WAN APPLIANCES TO ACHIEVE UNINTERRUPTED BUSINESS CONTINUITY

Published by Gbaf News

Posted on July 18, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 18, 2014

3 min readLast updated: January 22, 2026

Bremer anticipates saving nearly $200K per year with Talari by swapping costly MPLS backup links for inexpensive DSL circuits, while expanding redundancy and improving application performance, network operation and visibility

Talari Networks, Inc., a leading innovator in network reliability and business continuity solutions, announced Bremer Bank has deployed Talari’s family of Adaptive Private Networking (APN) WAN appliances in its headquarters and data center located in St. Paul, Minn. and is currently rolling out to more than 100 branch locations throughout Minnesota, Wisconsin and North Dakota. Bremer Bank is a privately held $8.7 billion regional financial services company.

Talari Networks, Inc., a leading innovator in network reliability and business continuity solutions, announced Bremer Bank has deployed Talari’s family of Adaptive Private Networking (APN) WAN appliances in its headquarters and data center located in St. Paul, Minn. and is currently rolling out to more than 100 branch locations throughout Minnesota, Wisconsin and North Dakota. Bremer Bank is a privately held $8.7 billion regional financial services company.

Deploying Talari has allowed Bremer to add new business-critical applications, including desktop video conferencing and collaboration, while simultaneously reducing spend on WAN circuits. Talari’s solution is satisfying three main requirements for Bremer Back. First, executing failovers quickly enough to prevent session interruptions. Second, allowing aggregation of primary and backup links to utilize all bandwidth full-time. And third, allowing future bandwidth growth through broadband circuits rather than costly MPLS.

Before deploying Talari, Bremer ran a thorough evaluation, during which Bremer’s network operations team set up a test environment connecting Talari to an MPLS and DSL circuit to demonstrate rapid failover without loss of sessions when introducing latency, jitter and loss, and disconnecting and reconnecting circuits. Just two days after three pilot branch locations were deployed, the MPLS circuit at one branch went down. Talari performed as expected, immediately transferring MPLS traffic to the DSL backup.

“Our staff at the branch never knew the circuit had failed,” said Bremer Bank’s VP of Engineering Services Cory Miller. “Before Talari, it would have brought business to a halt.”

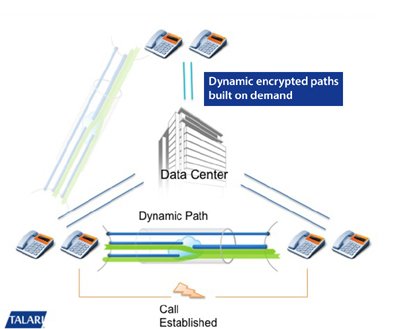

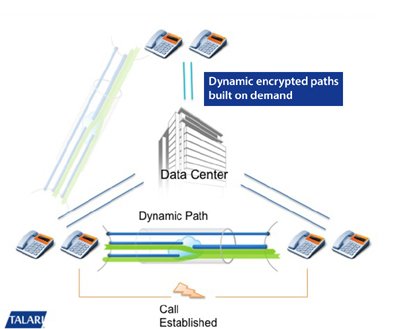

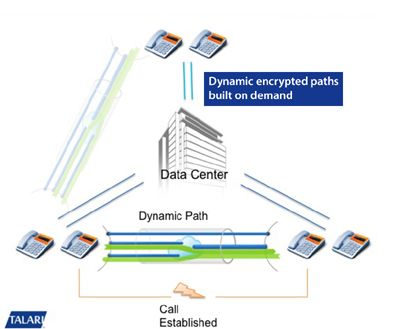

Additionally, Talari enabled the bank to create encrypted tunnels from the branch to the data center for all traffic across all circuits (MPLS, DSL, broadband or cable). As part of the evaluation, Miller determined that the encryption conformed to the Bank’s internal compliance guidelines. Talari enforces QoS (Quality of Service) across all service providers and circuits. Network operations don’t have to configure circuits from different providers since there is only one configuration to learn and manage. “With Talari, I’m assured granular QoS across every Talari-connected circuit,” says Miller.

Miller continued, “We can leverage Talari’s capabilities to negotiate the highest bandwidth at the lowest cost without compromising reliability/availability in preparation for more rich content, video and streaming applications in the future.”

The benefits to Bremer Bank using Talari include:

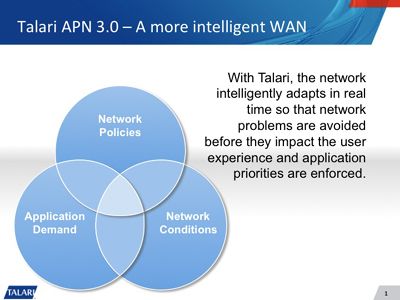

At the heart of Talari’s WAN appliances is its patented APN operating software, which aggregates broadband, leased-line and other links to achieve greater reliability. APN performs sub-second analysis and builds a real-time map of the quality of those links to determine where to send each packet, then applies a Quality of Service (QoS) engine to prioritize which applications use the best links at any given time. The end result is a highly resilient WAN seamlessly adapting to changing conditions in the underlying network and ensures applications operate without disruption and at a high level of quality.

At the heart of Talari’s WAN appliances is its patented APN operating software, which aggregates broadband, leased-line and other links to achieve greater reliability. APN performs sub-second analysis and builds a real-time map of the quality of those links to determine where to send each packet, then applies a Quality of Service (QoS) engine to prioritize which applications use the best links at any given time. The end result is a highly resilient WAN seamlessly adapting to changing conditions in the underlying network and ensures applications operate without disruption and at a high level of quality.

Explore more articles in the Banking category