Alaamry Global Capital’s Annual Letter: Saudi Investor Khalid Alaamry on Strategic Thinking for International Markets.

Published by Jessica Weisman-Pitts

Posted on January 22, 2025

9 min readLast updated: January 23, 2025

Published by Jessica Weisman-Pitts

Posted on January 22, 2025

9 min readLast updated: January 23, 2025

Over the years, I have had numerous conversations with friends and family about the stock market,

Over the years, I have had numerous conversations with friends and family about the stock market, investment strategies, and the current landscape of opportunities. Many have asked about the rationale behind our fund's strategy, particularly our exposure to Chinese equities, and how we approach decision-making in such a complicated environment. These discussions have made me realize the importance of educating investors on how to think about the market—focusing on fundamentals, research, and a disciplined approach to investing.

The purpose of this letter is to share insights on how we evaluate investment opportunities, both within our fund and as a general investment principle. I’ve included case studies and real-world examples to illustrate how we apply these principles, with a special focus on China, which we believe is an undervalued market with strong upside potential. Through this, I hope to provide guidance on how investors can make decisions based on data and facts rather than emotion or sentiment.

At Alaamry Global Capital, our strategy is simple: we invest in exceptional companies trading below their intrinsic value. We target businesses with:

We prioritize investing in companies with founder-led management teams. Some 85% of our portfolio comprises companies where, on average, 30% of outstanding shares are held by insiders.

By purchasing such companies at discounted prices, we create a margin of safety that protects against potential downside risks while maximizing long-term returns.

These opportunities often arise during periods of economic uncertainty, industry challenges, or company-specific issues. Negative market sentiment and short-term panic drive stock prices below fair value, offering attractive entry points for long-term investors.

As Benjamin Graham wisely observed:

“Markets are a voting machine in the short term but a weighing machine in the long term”.

In today’s technology-driven world, average holding periods for stocks have dramatically declined from eight years in the 1950s to under six months. This short-term focus allows us to capitalize on undervalued stocks, holding them through recovery for superior long-term returns.

China, the world’s second-largest economy, offers an unparalleled investment opportunity. Despite achieving the “Chinese Miracle” with an average annual growth rate of 10% over three decades, its stock market remains significantly discounted.

The Hang Seng Index, which peaked at 31,000 in 2021, has dropped 53% to lows of 14,687. This decline surpasses the 25% covid-19 crash and is comparable to the 57% drawdown during the Global Financial Crisis (GFC).

To put this into perspective, a similar performance in the S&P 500 would place it at around 1,928 points—three times cheaper than its current level of over 6,000. Such a decline would erase a decade of gains, much like the Hang Seng’s drop wiped out 15 years of returns.

Currently, the Hang Seng trades at roughly one-third the valuation of the S&P 500, presenting a compelling opportunity.

As Baron Rothschild famously said:

"The time to buy is when there's blood in the streets."

Historically, the US market has experienced prolonged periods of flat or negative returns:

Market recoveries after such downturns have been robust:

The US market’s current price-to-earnings (PE) ratio is at 27, nearing dot-com bubble levels and nearly double its historical mean of 15.8. The Hang Seng Index PE is at 10, significantly below its 20-year average of 15.19.

The last time the US market PE ratio reached a level similar to the 10 of the Hang Seng was during the 2008 GFC. Since then, the S&P has delivered an impressive 878% return, or 15.6% annually (excluding dividends).

China’s stock market offers attractive valuations compared to the US. The low Hang Seng Index PE ratio signals the potential for a strong rebound. If the index reverts to its 20-year average, it could rise to 30,000,a 50% upside. A return to its historic high P/E of 21.2 would push the index above 40,000, offering a potential 100% upside.

As Warren Buffett wisely stated:

“Be fearful when others are greedy and greedy when others are fearful”

Warren Buffett’s preferred valuation metric, the Buffett Indicator, compares total stock market capitalization to GDP.

This signals significant overvaluation in the US and makes China nearly 3.5 times cheaper

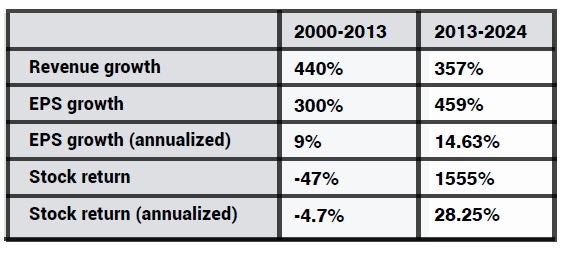

Microsoft’s “lost decade” (2000–2010) offers valuable insights to investors. During this period, despite strong fundamentals, the stock delivered zero returns for a decade due to valuation contraction:

From 2013 to 2024, Microsoft’s fundamentals kept improving, leading to significant rerating:

Here is a comparison of Microsoft’s share-price returns with the growth in its fundamentals over those two periods.

Microsoft's fundamentals were strong in both periods, but stock returns varied due to valuation differences. This raises the question: Why do investors avoid low-valuation markets but flock to overvalued ones?

The takeaways from this case study:

Warren Buffett’s quote is worth mentioning here:

“Price is what you pay, value is what you get”

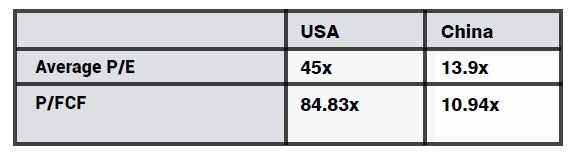

The contrast between the US and Chinese Magnificent Seven is stark.

US stocks are approximately 5.50 times more expensive than their Chinese counterparts. Like Microsoft’s post-lost decade recovery, China’s large caps could experience similar rerating.

Currently, insiders in US companies are happy to sell their stock knowing the shares are at all-time peak valuations. At the current S&P 500 level of 6,000, US insiders are selling stock in record volume.

This reinforces our belief that the China market is where the opportunity lies. If insiders do not have confidence in their own companies in the US, why should we put our money in their companies?

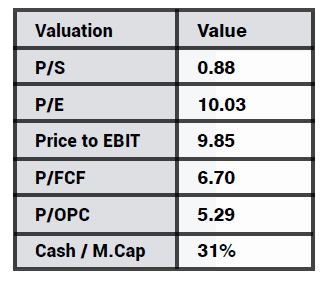

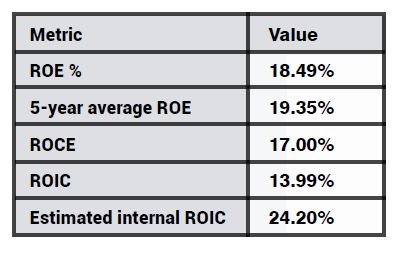

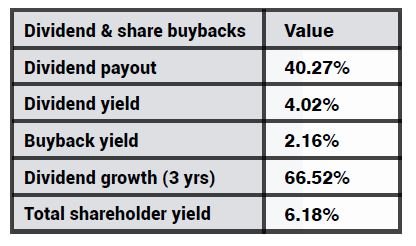

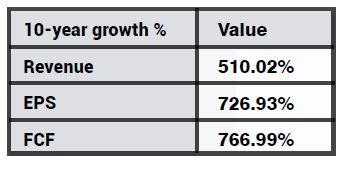

Our China-based portfolio demonstrates compelling valuation and fundamentals:

During a business trip to China, I met the CEO of a portfolio company who had grown his business into a multibillion-dollar enterprise with a 38-fold increase in free cash flow over a decade and a 10-year average ROE of 21.32%. Despite this success, his stock had dropped 60% from 2021 highs, leaving him puzzled and unhappy.

I assured him that short-term market irrationality doesn’t negate strong fundamentals. I recounted how some of the stocks I owned had a drawdown of over 90% but they turned around eventually to become 10-baggers. I also reassured him that, as the CEO, he is best suited to determine his company's health. Soon after, I noticed from the public filings that he began personally buying back shares, demonstrating confidence in his company and alignment of interest with shareholders, traits I admire deeply.

We focus on amazing, founder-led companies with strong insider ownership and high returns on capital. These businesses are available at single-digit valuations—70% cheaper than their US counterparts.

If a company is twice as good as average but priced at half the average, in a way I would consider it a four-times better investment opportunity.

However, not every good company is a good investment & vice versa. At Alaamry Global Capital, we balance valuation and quality to achieve long-term returns. Instead of listing what we do, here’s what we avoid:

While many fund managers avoid markets like China due to weak Market sentiment, we embrace long-term opportunities and invest our own capital, aligning fully with our investors' interests.

We focus on studying businesses minutely, investing only when they meet our stringent criteria. A guiding question we ask is: Would we own this business if the stock market was closed for the next 10 years? This long-term perspective helps us ignore short-term price fluctuations.

My investment journey began over 15 years ago, shaped by experiences like the 2011 Japan tsunami, when strong companies traded at discounts unrelated to their fundamentals. This reinforced my belief in value investing. It’s a philosophy I continue to apply successfully today, hoping to benefit both my community and the Kingdom of Saudi Arabia.

Warren Buffett boasted during the GFC: “Buy American, I am”. Like him, I now say, “Buy China, I am.”

I hope this letter provides valuable insights into our philosophy. Just as I have learned from others’ writings, I aspire for my reflections to help strengthen your investment perspective by encouraging you to read and learn continuously.

Post script: For more details on the reflections shared in this note, please ask us for our Annual Shareholder Letter for 2024 by clicking here or through our website.

Explore more articles in the Business category