Quantum computing stocks take a hit as Nvidia CEO predicts long road ahead

Published by Global Banking & Finance Review®

Posted on January 8, 2025

2 min readLast updated: January 27, 2026

Published by Global Banking & Finance Review®

Posted on January 8, 2025

2 min readLast updated: January 27, 2026

Quantum computing stocks fell as Nvidia CEO predicted practical use is two decades away, impacting market value by $3 billion.

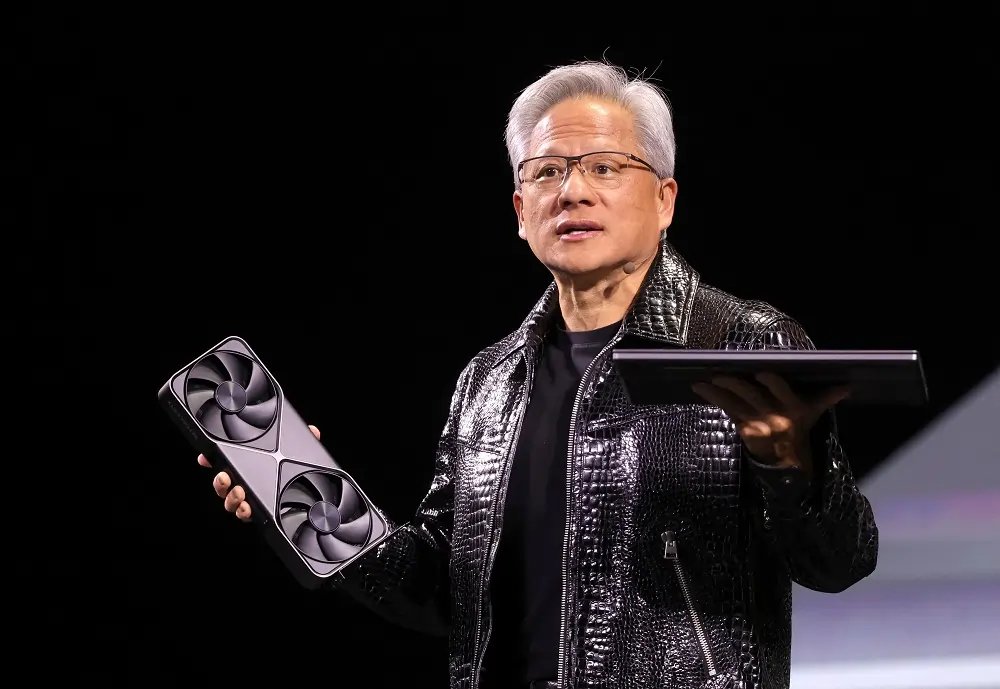

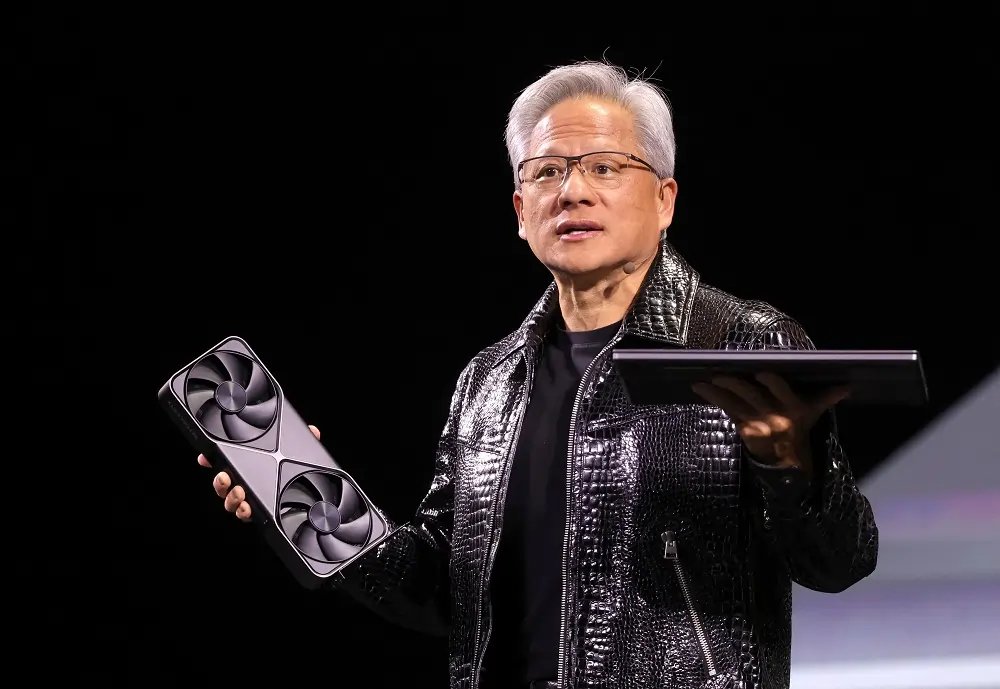

(Reuters) - Quantum computing stocks sank on Wednesday, pausing a year-long rally, after Nvidia CEO Jensen Huang said the technology's practical use was likely two decades away.

The long wait outlined by Huang for "very useful quantum computers" throws cold water on a sector that was already expected to spend millions more on the technology, which can only perform niche calculations so far.

"If you kind of said 15 years ... that'd probably be on the early side. If you said 30, it is probably on the late side. But if you picked 20, I think a whole bunch of us would believe it," he told an investor conference on Tuesday.

Shares of Rigetti Computing and Quantum Computing fell more than 17% each in trading before the bell, while IonQ and D-Wave Quantum fell 9.4% and 14%, respectively.

The companies were in total set to lose about $3 billion in market value, if losses hold.

Stocks of all the companies had risen at least three-fold last year, driven by a high-profile breakthrough at Alphabet-owned Google and increasing computing needs brought on by generative AI applications.

Google had in December unveiled a new generation chip that it said solved in five minutes a computing problem that would take a classical computer more time than the history of the universe, sparking a rally in its shares.

In April 2024, Microsoft and Quantinuum said they had achieved a key step in making quantum computers a commercial reality, but did not comment on how many more years it would take to beat a conventional supercomputer using the tech.

(Reporting by Arsheeya Bajwa in Bengaluru; Editing by Anil D'Silva)

The article discusses the decline in quantum computing stocks following Nvidia CEO's prediction of a long road to practical use.

Stocks fell after Nvidia CEO Jensen Huang predicted that practical quantum computing is still 20 years away.

Rigetti Computing, IonQ, and D-Wave Quantum saw significant stock declines.

Explore more articles in the Finance category